Labour Welfare Fund

Labour welfare fund is a statutory contribution managed by individual state authorities. The state labour welfare board determines the amount and frequency of the contribution. The contribution and periodicity of remittance differs with every state. In some states the periodicity is annual (Andhra Pradesh, Haryana, Karnataka, Tamil Nadu etc) and in some states it is to be contributed during the month of June & December (Gujarat, Madhya Pradesh, Maharashtra etc).

What is Labour Welfare Fund?

Labour welfare is an aid in the form of money or necessities for those in need. It provides facilities to labourers in order to improve their working conditions, provide social security, and raise their standard of living.

To justify the above statement, various state legislatures have enacted an Act exclusively focusing on welfare of the workers, known as the Labour Welfare Fund Act. The Labour Welfare Fund Act incorporates various services, benefits and facilities offered to the employee by the employer. Such facilities are offered by the means of contribution from the employer and the employee. However, the rate of contribution may differ from one state to another.

Scope of Labour Welfare Fund Act

The scope of this Act is extended to housing, family care & worker's health service by providing medical examination, clinic for general treatment, infant welfare, women’s general education, workers activity facilities, marriage, education, funeral etc. State-specific Labour Welfare Funds are funded by contributions from the employer, employee, and in a few states, the government also.

Applicability of the Act

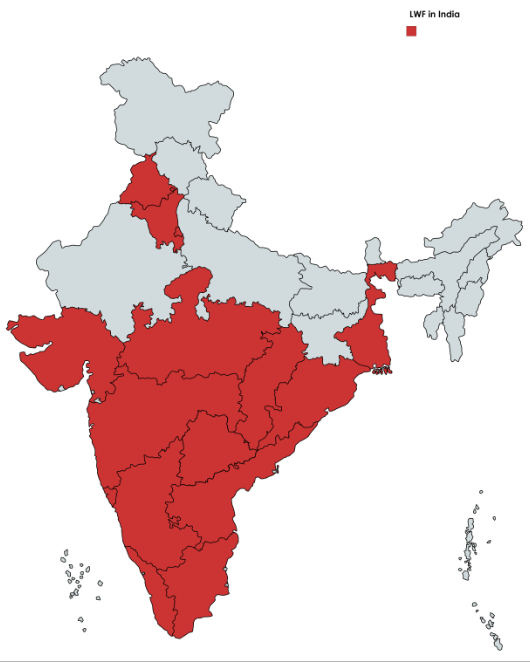

In order to provide social security to workers, the government has introduced the Labour Welfare Fund Act. This act has been implemented only in 16 states out of 37 states including union territories.

The below table depicts the states in which the Act has been implemented and not implemented:

| Applicable States | Not Applicable States |

|---|---|

| Andhra Pradesh | Central |

| Chandigarh | Andaman and Nicobar Islands |

| Chhattisgarh | Arunachal Pradesh |

| Delhi | Assam |

| Goa | Bihar |

| Gujarat | Dadra and Nagar Haveli |

| Haryana | Daman and Diu |

| Karnataka | Himachal Pradesh |

| Kerala | Jammu and Kashmir |

| Madhya Pradesh | Jharkhand |

| Maharashtra | Ladakh |

| Odisha | Lakshadweep |

| Punjab | Manipur |

| Tamil Nadu | Meghalaya |

| Telangana | Mizoram |

| West Bengal | Nagaland |

| Puducherry | |

| Rajasthan | |

| Sikkim | |

| Tripura |